The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

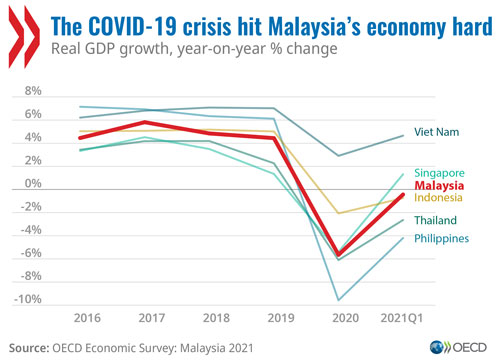

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

The standard corporate income tax rate in Malaysia is 24.

. However in the case of a resident company the Malaysia corporate tax rate can be applied at 17 or 24 from the yearly income the lower rate of 17 is not applicable to non-resident. Corporate tax rates for companies resident in Malaysia is 24. On the First 5000.

For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. On the First 5000 Next 15000. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Masuzi December 15 2018 Uncategorized Leave a comment 7 Views. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. What is the Corporate Tax Rate in Malaysia.

Malaysia Corporate Tax Rate History. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. Other corporate tax rates include the following.

New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible extension for. Malaysia was ranked 12 out of 190 countries for ease of doing. The amount of tax relief 2018 is determined according to governments graduated scale.

Home Income Tax GST FIR Online Online Filing Bare Acts Companies Act CPC CRPC IPC Legal Formats. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. 17 on the first RM 600000.

For the purpose of the Malaysia corporate tax rate a small or medium company is one that is incorporated in the country. Mulai Tahun Taksiran 2018 anggaran cukai perlu dihantar secara e-Filing e-CP204. 3 of audited income.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. The current CIT rates are provided in the following table. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967.

Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. A Look at the Markets. Malaysia Taxation and Investment 2018 Updated April 2018 1 10 Investment climate 11 Business environment.

A company registered under the MICSEZ is entitled to enjoy certain exemptions and relief from taxes see the Tax credits and incentives section for details. 20182019 Malaysian Tax Booklet 22 Rates of tax 1. Income tax rates.

These companies are taxed at a rate of 24 Annually. The income is generally subject to tax under the normal rules for residents. Tax Relief Year 2018.

The standard rate of corporate tax in Malaysia in 2021 is 24. This rate is relatively lower than what we have seen in the previous year. Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in. That does not control. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here.

Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits. Prior to 1 October 2021 the corporate tax rate was 25. Small and medium enterprises SMEs pay slightly different company tax as compared.

Taxplanning budget 2018 wish list audit tax accountancy in johor bahru comparing tax rates across asean malaysian tax issues for expats. Corporate tax rate for resident small and medium-sized enterprises with capitalization under MYR 25 million 17 on the first MYR 600000. Historical Chart by prime ministers.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. 24 above MYR 600000. The carryback of losses is not permitted.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. For small and medium enterprises SME with paid-up capital not more than 25 million the first RM500000 Chargeable Income will be taxed at 18 effective from year of assessment 2019 the rate is 17 and the Chargeable Income above RM500000 will be taxed at 24. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment.

Bayaran Ansuran Syarikat. Taxplanning Budget 2018 Wish List The Edge Markets. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on.

Malaysia Corporate Tax Rate 2018 Table. Corporate companies are taxed at the rate of 24. Gold Analysis Twist Could Cause Inflation to Challenge 133 Not Seen Since 1979.

CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual. Small and medium companies are subject to a 17 tax rate with the balance in this case being subject to the 24 rate. Malaysia Corporate Tax Rate was 24 in 2022.

In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Rate TaxRM A. 24 in excess of RM 600000.

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Income Tax Malaysia 2018 Mypf My

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

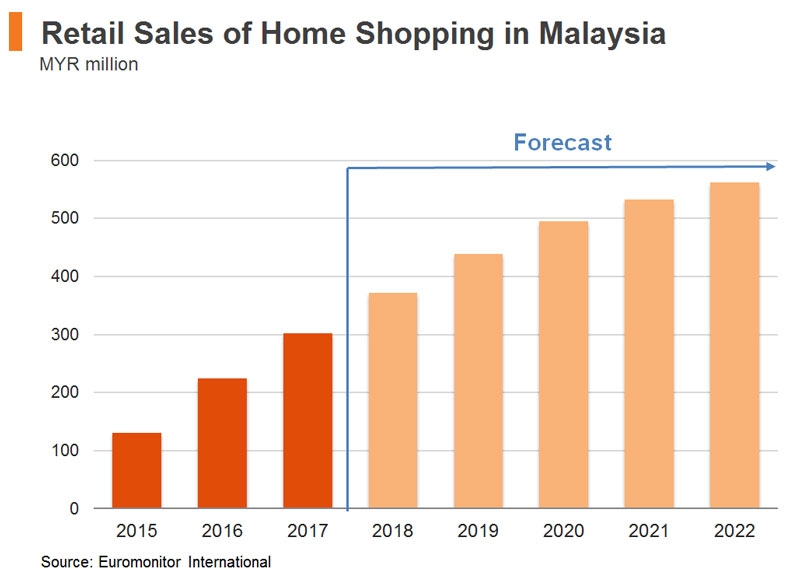

Malaysia Distribution Channels And Entry Strategies Houseware And Small Home Appliances Hktdc Research

Asia Tire Market Report Commercial Vehicle Marketing Tire

Gst In Malaysia Will It Return After Being Abolished In 2018

Why Mauritius Is The 2nd Fastest Growing Wealth Market After China Growing Wealth Wealth Economic Trends

2018 Public Holidays In Malaysia School Holiday Programs Tuition Centre School Holidays

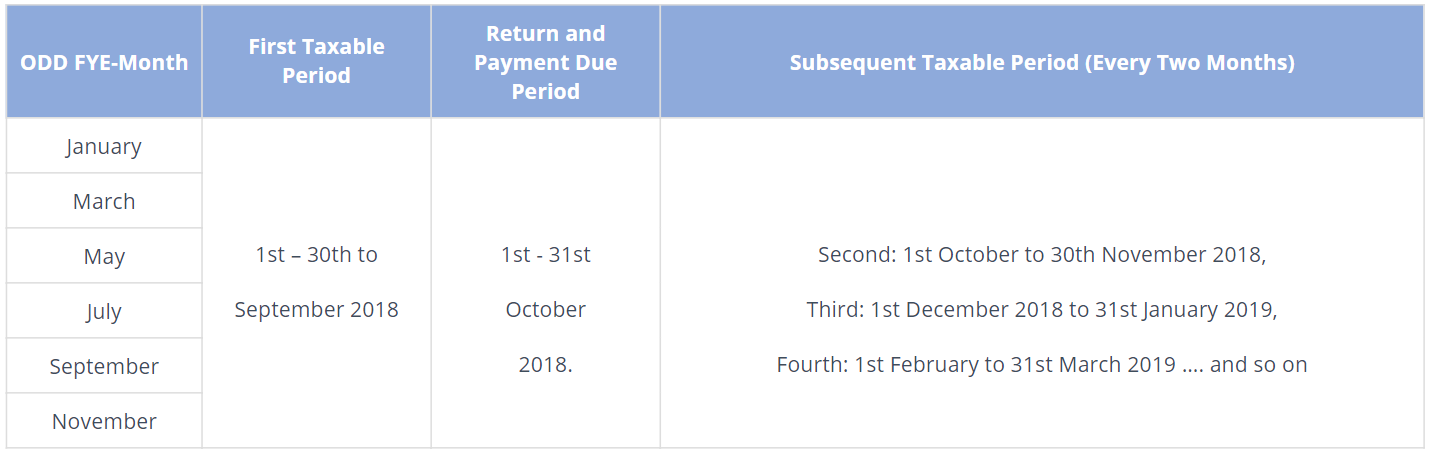

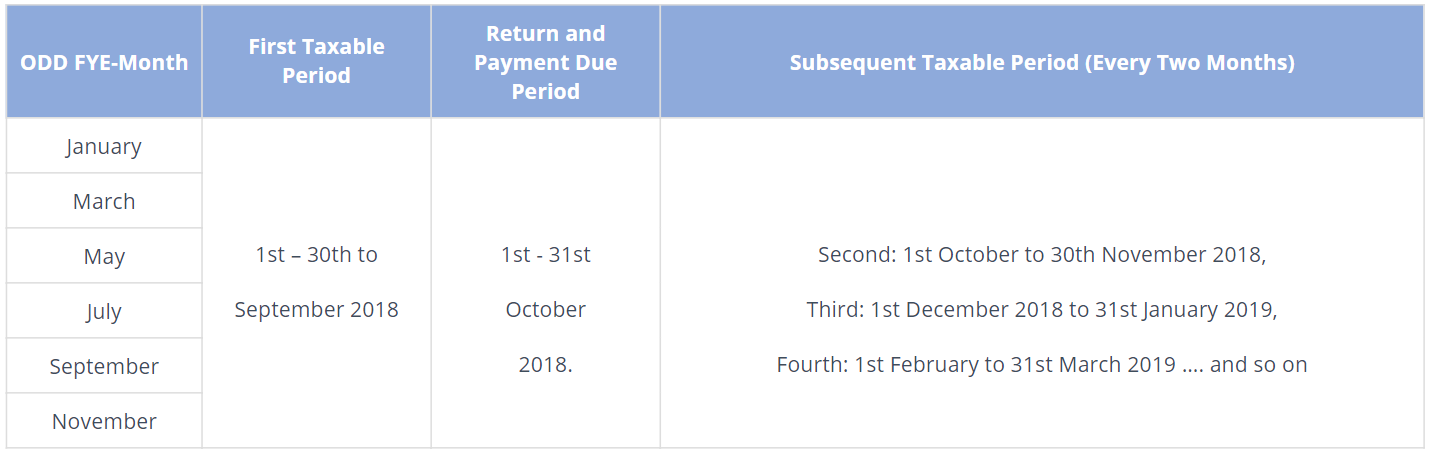

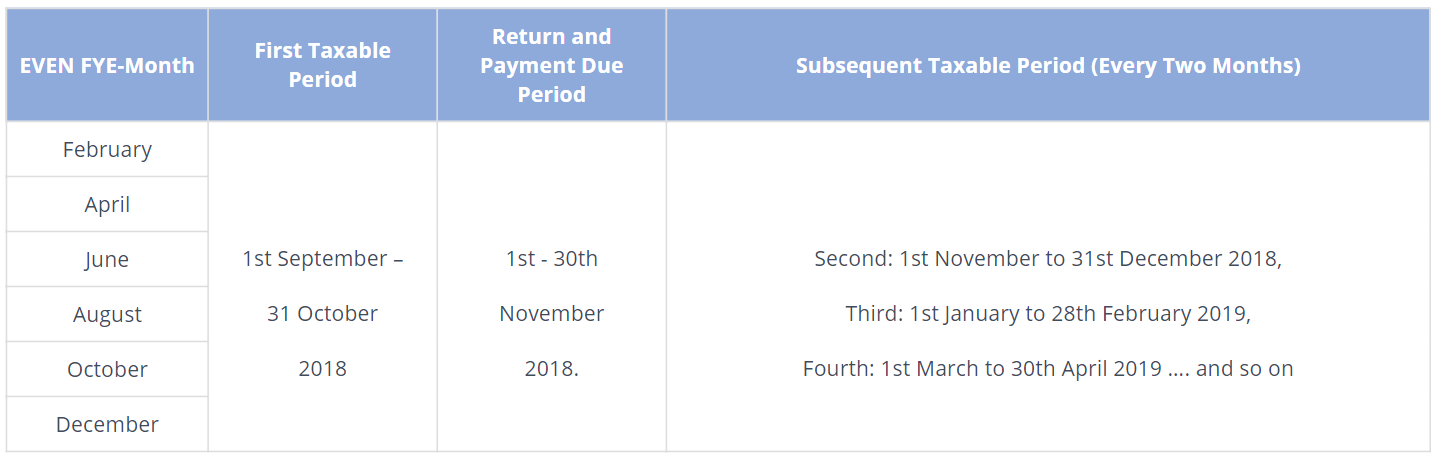

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Last Year Icn Turned Out To Be One Of The Best Performing Ipos In Thailand Ipo Radar Icn Nokia Siemens Best Buddy They Are Words Networking Good Buddy

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysia Further Reforms To Boost Business Dynamism Would Strengthen The Recovery From Covid 19 Says Oecd

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Why It Matters In Paying Taxes Doing Business World Bank Group